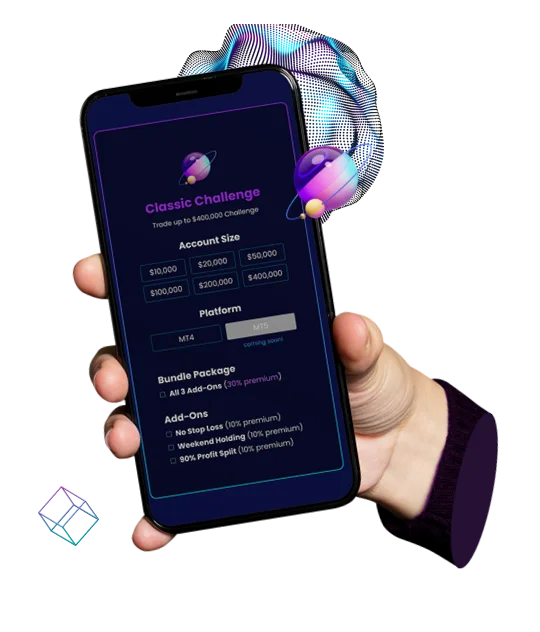

Introduction to the Classic Challenge

The Classic Challenge is a two-step evaluation. During the Ultimate Traders Challenge phase (first step) the trader must reach a specific profit target, over a minimum of three trading days, without getting drawn down below the maximum daily and all-time limit. During the Verification phase (second step) the trader must partially replicate the success of the first phase, by reaching at least half the profit under the same constraints. In other words, you ‘verify’ that your trading success was legitimate.